Early Retirement

My wife was in a dead-end career as a travel

agent, earning less than $15,000 per year at

a job that was quickly turning obsolete. It was

1998 and we had been saving for 7 years –

nearly half of a 15-year retirement plan –

and yet we still only had a nest egg of

about $68,000. Robin realized she had

to invest in herself first before she could

do much to help with investing for our retirement. So for 1½ years

she went back to school to reinvent herself and become a nurse.

Think of it: here we were, in the midst of our primary investing

years, and instead of earning money... Read More

agent, earning less than $15,000 per year at

a job that was quickly turning obsolete. It was

1998 and we had been saving for 7 years –

nearly half of a 15-year retirement plan –

and yet we still only had a nest egg of

about $68,000. Robin realized she had

to invest in herself first before she could

do much to help with investing for our retirement. So for 1½ years

she went back to school to reinvent herself and become a nurse.

Think of it: here we were, in the midst of our primary investing

years, and instead of earning money... Read More

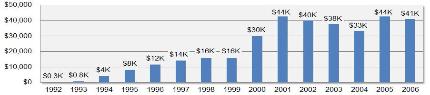

Nobody’s saying it’s easy to retire early on an average salary, but

it's not impossible either. It took us 15 years to get rich slowly,

investing steadily month by month until we had amassed a nest egg

of nearly $1 million -- enough to safely generate about $40,000 per

year. Here's how much we invested per month. Read More

it's not impossible either. It took us 15 years to get rich slowly,

investing steadily month by month until we had amassed a nest egg

of nearly $1 million -- enough to safely generate about $40,000 per

year. Here's how much we invested per month. Read More

Early retirement is not a pipedream: it is

achievable and primarily a question of

priorities and determination. What we

accomplished by investing in index

funds in a slow and steady fashion is

definitely repeatable by normal human

beings with normal everyday jobs and

lives. So let’s debunk four myths about

early retirement while finding the kernel of truth hidden at the heart

of each. Myth #1: You can't retire early unless you... Read More

achievable and primarily a question of

priorities and determination. What we

accomplished by investing in index

funds in a slow and steady fashion is

definitely repeatable by normal human

beings with normal everyday jobs and

lives. So let’s debunk four myths about

early retirement while finding the kernel of truth hidden at the heart

of each. Myth #1: You can't retire early unless you... Read More

| Free Investment Spreadsheet (Excel) |

Downsizing for life on the road requires a new way

of thinking about packing... Read More

of thinking about packing... Read More

If you plan to travel

overseas for several

months, consider

buying a used car.

It gives you the

freedom to go where

you want when you

want. For example,

at New Zealand's

Auckland Car Fair...

Read More

overseas for several

months, consider

buying a used car.

It gives you the

freedom to go where

you want when you

want. For example,

at New Zealand's

Auckland Car Fair...

Read More

If you’re planning a simple

early retirement, you stand a

good chance of paying much

lower income taxes than

you've grown accustomed to

in your working years. While

your income tax may not

always be zero in retirement,

it could quite conceivably be

10% or less. This is good news if you’re thinking of retiring early on

less. Let’s look at our own situation as an example... Read More

early retirement, you stand a

good chance of paying much

lower income taxes than

you've grown accustomed to

in your working years. While

your income tax may not

always be zero in retirement,

it could quite conceivably be

10% or less. This is good news if you’re thinking of retiring early on

less. Let’s look at our own situation as an example... Read More

Never underestimate the value of a

good travel ring. By travel ring I

mean a substitute ring as a

placeholder for your engagement

ring or wedding band that you wear

only when you are traveling. We all

know how much sentimental as well

as monetary value can be attached

to the originals.... Read More

good travel ring. By travel ring I

mean a substitute ring as a

placeholder for your engagement

ring or wedding band that you wear

only when you are traveling. We all

know how much sentimental as well

as monetary value can be attached

to the originals.... Read More

| Travel-Related Articles |

When the headlines are screaming

“Dow Plummets!” and “S&P 500 Hits

New Lows!” you should be smiling and

thinking to yourself, “Blowout Sale on

Stocks! Limited Time Only!” Until we

retired, we always welcomed bad news

in the stock market. Why? Because

bad news is actually good news for...

Read More

“Dow Plummets!” and “S&P 500 Hits

New Lows!” you should be smiling and

thinking to yourself, “Blowout Sale on

Stocks! Limited Time Only!” Until we

retired, we always welcomed bad news

in the stock market. Why? Because

bad news is actually good news for...

Read More

We've heard it suggested that

investment timing was crucial to our

success in retiring early -- that we

started investing in the 1990's when

the stock market was roaring and

that the results we attained aren't

necessarily repeatable by others

under today’s market conditions.

Is this true? Did we benefit from exceptional market timing?

Read More

investment timing was crucial to our

success in retiring early -- that we

started investing in the 1990's when

the stock market was roaring and

that the results we attained aren't

necessarily repeatable by others

under today’s market conditions.

Is this true? Did we benefit from exceptional market timing?

Read More

Why peer through a peephole

when you can look out a picture

window? That's what we wonder

when we see investors peering

through a narrow window at just

one year’s fund or market results.

Whether the results are good or

bad hardly matters -- it's that the

view itself is distorted by the narrow dimensions. By looking through

a bigger window – at 10, 20, or even 100 years of results – the

picture suddenly becomes clearer. Read More

when you can look out a picture

window? That's what we wonder

when we see investors peering

through a narrow window at just

one year’s fund or market results.

Whether the results are good or

bad hardly matters -- it's that the

view itself is distorted by the narrow dimensions. By looking through

a bigger window – at 10, 20, or even 100 years of results – the

picture suddenly becomes clearer. Read More

People have a natural curiosity about

just how much an author can make as a

result of publishing a book. And if that

book happens to be about retiring early

(as ours is), then the curiosity can be

even stronger because folks wonder

whether the book itself is what’s allowing

the author to escape the nine to five

routine. Well, we’re here to set the

record straight. Below we post our actual

book royalties to date... Read More

just how much an author can make as a

result of publishing a book. And if that

book happens to be about retiring early

(as ours is), then the curiosity can be

even stronger because folks wonder

whether the book itself is what’s allowing

the author to escape the nine to five

routine. Well, we’re here to set the

record straight. Below we post our actual

book royalties to date... Read More

Here are 10 reasons

you should consider

bringing resealable

plastic bags on your

next trip. Read More

you should consider

bringing resealable

plastic bags on your

next trip. Read More

Just across the border from

Yuma, Arizona is a hidden

gem for the budget-minded:

Algodones, Mexico. This is

our new go-to place for

three things at reasonable

prices: dental, vision, and

prescription drugs. It's like

a huge medical tourism...

Read More

Yuma, Arizona is a hidden

gem for the budget-minded:

Algodones, Mexico. This is

our new go-to place for

three things at reasonable

prices: dental, vision, and

prescription drugs. It's like

a huge medical tourism...

Read More

One of the best things we did in life

was accomplish our dream of early

retirement. That said, looking back I'm

also very glad we stopped to smell the

roses along the way. It takes disci-

pline and hard work to save for early

retirement, but you don’t want to miss

out on the good life has to offer while

you strive to achieve it. Surprisingly,

some of my favorite memories...

Read More

was accomplish our dream of early

retirement. That said, looking back I'm

also very glad we stopped to smell the

roses along the way. It takes disci-

pline and hard work to save for early

retirement, but you don’t want to miss

out on the good life has to offer while

you strive to achieve it. Surprisingly,

some of my favorite memories...

Read More

What makes this book different from all the other books out there

on early retirement? We think it's the amount of personal financial

detail we provide. We don’t hold back! You can use this information

as a kind of financial yardstick to measure what is possible in your

own life.

on early retirement? We think it's the amount of personal financial

detail we provide. We don’t hold back! You can use this information

as a kind of financial yardstick to measure what is possible in your

own life.

A tiny condo fits quite

well with our retirement

travel lifestyle -- and

living in a tiny home can

also dovetail perfectly

with your plans for early

retirement. Here’s why...

Read More

well with our retirement

travel lifestyle -- and

living in a tiny home can

also dovetail perfectly

with your plans for early

retirement. Here’s why...

Read More

The steps we followed are repeatable and relatively easy to

implement by normal human beings with normal jobs and lives.

That's our primary message: that retiring early is not a pipedream,

but something achievable and very much worth achieving.

implement by normal human beings with normal jobs and lives.

That's our primary message: that retiring early is not a pipedream,

but something achievable and very much worth achieving.

"I am a financial advisor and I enjoyed this book very much. I am

planning on adding the print version of this to the lending library I

keep for clients -- this is saying something -- I read and discard

probably 6 or 7 financial books to every one I keep to lend..."

planning on adding the print version of this to the lending library I

keep for clients -- this is saying something -- I read and discard

probably 6 or 7 financial books to every one I keep to lend..."

"I have read dozens of retire early / personal finance books and I

can say with confidence this is the best. I bought the Kindle

version but then decided to buy four more paperbacks to give as

graduation presents to my graduating son and nieces and

nephews. I feel this book encompasses all the necessary topics to

get a financial life on track whether it be young or old. I highly

recommend this book!!"

can say with confidence this is the best. I bought the Kindle

version but then decided to buy four more paperbacks to give as

graduation presents to my graduating son and nieces and

nephews. I feel this book encompasses all the necessary topics to

get a financial life on track whether it be young or old. I highly

recommend this book!!"

Best retirement / personal

finance book I have ever read!!

finance book I have ever read!!

Inspiring

"This is a fantastic book. If you are interested in retiring early and

want to figure out how to, and I mean not only theoretically, but in

a completely concrete and hands-on way, then this is exactly the

book you need. I cannot recommend this book highly enough!...

want to figure out how to, and I mean not only theoretically, but in

a completely concrete and hands-on way, then this is exactly the

book you need. I cannot recommend this book highly enough!...

The perfect book on early

retirement planning

retirement planning

The ten-year mark seems like a natural

time to step back and see how you’re

doing with any big decision in life. So

how are we doing ten years after

retiring early? The short answer is,

great! As of January 2017 our nest egg

stands at... Read More

time to step back and see how you’re

doing with any big decision in life. So

how are we doing ten years after

retiring early? The short answer is,

great! As of January 2017 our nest egg

stands at... Read More

| Net Worth: May 2021 |

As of May 2021 our nest egg stands at $1.5 million and our net worth (including condo) at over $1.75 million.

For comparison purposes, we began our early retirement 14 years ago in Dec 2006 at age 43 with a net worth of $925K, so we've seen our nest egg and net worth go up, not down, while still withdrawing 3% to 4% in living expenses from investments each year on average. We think this is powerful evidence that your money really can work for you so you don't have to.

Note: We've received no financial help of any kind from any

outside source throughout our financial journey. We've

always tried to be up-front about our finances to give others

on the same path an idea of what to expect, so in that spirit

we've provided this progress report to hopefully inspire you

to keep on investing!

For comparison purposes, we began our early retirement 14 years ago in Dec 2006 at age 43 with a net worth of $925K, so we've seen our nest egg and net worth go up, not down, while still withdrawing 3% to 4% in living expenses from investments each year on average. We think this is powerful evidence that your money really can work for you so you don't have to.

Note: We've received no financial help of any kind from any

outside source throughout our financial journey. We've

always tried to be up-front about our finances to give others

on the same path an idea of what to expect, so in that spirit

we've provided this progress report to hopefully inspire you

to keep on investing!

1) The Camino de Santiago is

as much an internal journey as

an external one. Whether a

village is pleasant and

memorable is very much based

on one's mood while there.

2) Walking forces you to focus

on only what is in your path

today, and not worry about

tomorrow's experiences.

Read More

as much an internal journey as

an external one. Whether a

village is pleasant and

memorable is very much based

on one's mood while there.

2) Walking forces you to focus

on only what is in your path

today, and not worry about

tomorrow's experiences.

Read More

| Other Articles |